MoneyWeek is a weekly magazine that enables you to become a better-informed, smarter investor and enjoy the rewards of managing your money with confidence. Week-in, week-out we'll guide you through the financial world as it changes, alerting you to all the opportunities to profit and dangers to avoid, as they appear. Income strategies, rising-star companies, the best funds and trusts, clever ways to preserve your wealth during market turmoil... you will get the best ideas from the sharpest financial minds and investing professionals in Britain.

From the editor...

Tulip Siddiq had to go

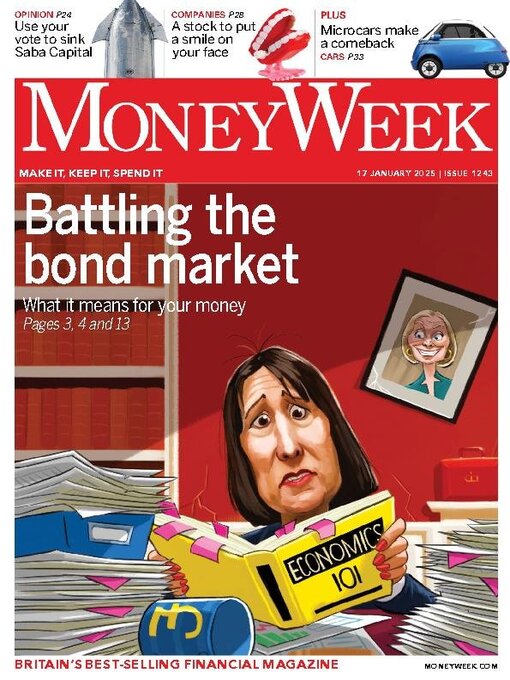

Britain’s battle with the bond market

Hedge funds bet on sterling swoon

RFK’s shake-up of US healthcare

Bracing for Trump’s tariffs

Viewpoint

■ American economy is firing on all cylinders

A power surge in the US • Nuclear group Constellation Energy is to buy gas and geothermal specialist Calpine Corp to bulk up for higher demand. Matthew Partridge reports

J&J pops a mood pill

M&S and Tesco’s festive figures

MoneyWeek’s comprehensive guide to this week’s share tips

A German view

IPO watch

Britain cosies up to China • But is that really such a good idea? Emily Hohler reports

Croatia’s Donald Trump wins the presidency

Edging closer to peace in Gaza

News

Will Trump invade Greenland? • Probably not, but there’s a rationale behind what he says he wants. Simon Wilson explains

Rachel Reeves must go • The chancellor has no answer to the deep crisis she finds herself in. It would be better to fire her sooner rather than later

City talk

Shift into short-term bonds • With so much uncertainty about long-term rates, it makes sense to cut exposure to long bonds

I wish I knew what currency hedging was, but I’m too embarrassed to ask

Guru watch

The best strategy for the UK • Recovery stocks outperformed the market in 2024 and are likely to keep doing so

Activist watch

Short positions... Fundsmith lags the index again

Best of the financial columnists

Money talks

How to get Britain building

Can Musk shrink the state?

How to be a better tourist

Britain narrowly avoids blackout

Why British growth has lagged • Our poor productivity is due to several factors that are our own fault, says David C. Stevenson

Profit from the scramble for metals and minerals • Copper and other metals will be vital in the transition to cleaner technologies and artificial intelligence. Soaring demand is pushing prices up. Smart investors should buy in now. Matthew Partridge reports

The best investments to buy now

The world returns to rationality • Higher rates are restoring common sense, says Merryn Somerset Webb

Fight the Pirates of the Caribbean • US hedge fund Saba Capital Management wants to take over seven UK trusts. Shareholders must resist, says Max King

Top financial resolutions • More than 50% of Britons have resolved to grow their savings in 2025

Mortgage rates rise again

Pocket money... the Christmas tax-return rush

Keep staff costs down • There are several ways to avoid having to freeze hiring or let employees go

Prepare for new workers’ rights

Petty cash... new online platform for SMEs

A stock to put a smile on your face • Straumann Holding is a global leader in the premium dental-care market

Sezzle lacks sizzle, so sell • The US buy-now-pay-later provider is resting on shaky foundations

Betting on politics... Germany’s election

How my tips have fared

Transformed companies displaying momentum and top-quality growth • A professional investor tells us...

1246-1247

1246-1247

1245

1245

1244

1244

1243

1243

1242

1242

1240-1241

1240-1241

1239

1239

1238

1238

1237

1237

1236

1236

1235

1235

1234

1234

1233

1233

1232

1232

1231

1231

1230

1230

1229

1229

1228

1228

1227

1227

1226

1226

1225

1225

1224

1224

1222

1222

1221

1221